Remember how I promised I was going to start spending less and saving more as one of my New Year's resolutions? Yeah, it hasn't been going so well. Among the long list of unnecessary items I've purchased this month are: new dresses, woodland animal temporary tattoos, Whole Foods fruit salads, and about $170 worth of mixed drinks (that might prompt a resolution for next year...).

The first mistake I made was not setting a budget from the get go. Instead I told myself unsubscribing from the 20 daily retail email-blasts and cutting out the weekly trips to Target would be enough. While I did spend less than I usually do by stopping those things, I filled that hole by eating and going out more frequently.

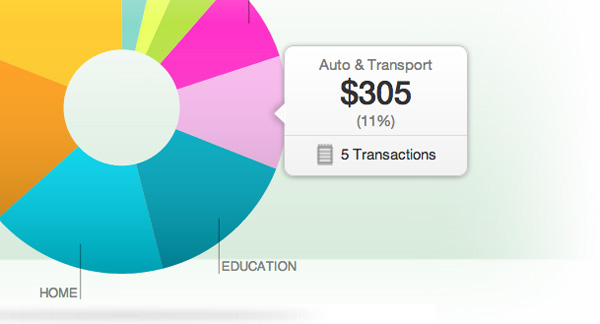

So tonight as my roommate was going over her monthly budget, I decided I should do the same before February rolls around. After a bit of searching budgeting tips for 20-somethings I came across Mint. If you've never used it, Mint is a super slick app that syncs up with your bank account and categorizes all of your purchases to automatically create a budget for you (or you can edit it manually of course). I found this extremely useful since I really had no clue how much I should budget for clothes or how often I could realistically be ordering Jimmy John's. In addition, the app will send you emails/text messages when you go over budget, which I hope will keep me on track just out of fear of receiving a depressing message. Also, let's face it. Almost any app with a nice interface design receives four gold stars in my book.

Well, that's my spiel on this app. Even if you are not trying to budget your money, I recommend checking it out as it's an eye opener to how much you're actually spending on certain things. I'll let you know how it's working out for me in a few months!